Have you ever wondered if you could switch to solar power and save on energy bills without spending thousands upfront? As the push for clean, renewable energy intensifies, zero upfront cost solar panels are rapidly transforming home energy solutions

Unlocking Access: How Zero Upfront Cost Solar Panels Are Transforming Home Energy

Harnessing the sun’s energy has never been more achievable. Zero upfront cost solar panels remove the high front cost barrier, giving homeowners a path to renewable, affordable electricity. Providers now offer free solar panel installation with financing options like solar leases, solar loans, and power purchase agreements that let you start saving from day one. This breakthrough means even families who could not afford traditional solar systems can now reduce their energy bills, shrink their carbon footprint, and boost their home value—all without a large initial expense.

Unlike conventional solar systems that require significant investment up front, zero upfront cost programs are designed for accessibility. Homeowners benefit immediately, paying for their solar energy over time with monthly payments or by purchasing power generated at a discounted rate. This new approach is democratizing solar power, contributing to a cleaner environment, and putting the power of energy independence directly into your hands.

When considering your options, it's important to understand how broader political and economic factors can influence renewable energy initiatives. For example, shifts in government policy can impact incentives and job growth in the clean energy sector. If you're interested in how political actions have affected renewable energy employment, particularly in the wind industry, you may find this analysis on why political actions threaten offshore wind jobs in America especially insightful.

What You'll Learn About Zero Upfront Cost Solar Panels

- The concept and benefits of zero upfront cost solar panels

- Free solar panel options and qualification requirements

- Solar leasing, loans, and power purchase agreements: review and comparison

- Steps to begin your zero upfront cost solar panels installation

What Are Zero Upfront Cost Solar Panels?

So, what exactly are zero upfront cost solar panels? They refer to solar systems installed on your property with no large payment required at the start

Zero upfront cost programs focus on breaking down obstacles to solar adoption. Through partnerships, government incentives, and specialized solar companies, homeowners can access solar without a significant cash outlay, freeing up funds for other priorities while still enjoying the benefits of renewable energy.

Defining Zero Upfront Cost Solar Panels

Zero upfront cost solar panels are photovoltaic systems installed at your home without requiring you to pay large front cost. Instead, the cost is offset by monthly payments, leasing agreements, or power purchase arrangements. These setups are often made possible by solar companies that maintain ownership or a stake in your solar install, handling maintenance and warranties to ensure optimal power production and financial return.

Through this flexible financing, homeowners step into solar energy with no money down, making the transition both risk-free and budget-friendly. In most models, the panels and solar system are sized to cover a significant portion of your energy needs, maximizing your utility bill savings and accelerating your path to clean energy.

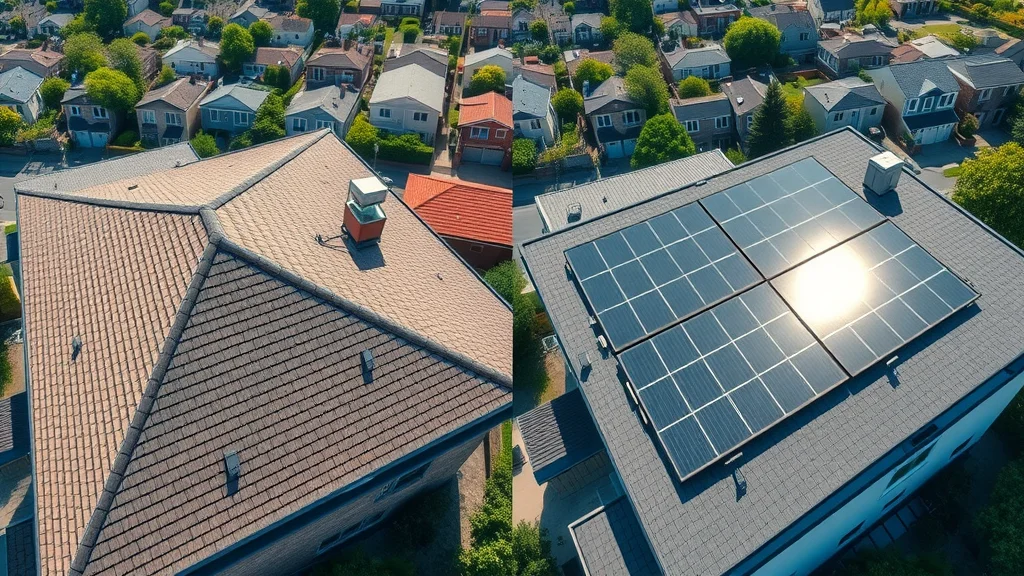

The Difference Between Zero Upfront Cost Solar Panels and Traditional Solar Panels

Traditional solar panel purchases typically involve purchasing and owning the full system outright. This means paying thousands of dollars up front for solar panel equipment, installation fees, and related costs. With zero upfront cost solar panels, those financial hurdles vanish. Homeowners can choose arrangements where someone else owns or finances the equipment, leaving you to benefit from solar savings through manageable, predictable monthly payments or by simply buying the energy at a reduced rate.

"With zero upfront cost solar panels, homeowners can go solar without the barrier of hefty initial payments — a game-changer for energy independence."

This model expands access, as more families can pursue solar energy—even without extensive savings or eligibility for federal tax credits at purchase. The result: faster adoption of clean power and long-term cost benefits for a growing number of homeowners.

Understanding Solar Panel Financing Options for Zero Upfront Costs

A pivotal part of accessing zero upfront cost solar panels is understanding the financing landscape. Several pathways—solar leases, solar loans, and power purchase agreements (PPAs)—provide diverse ways for homeowners to access free or reduced-cost solar panels, each with its own dynamics, advantages, and obligations. Let’s explore these solar financing options so you can select the right fit for your home and financial situation.

The right solar financing option can make the difference between an affordable transition and missed savings. Providers structure options to meet various homeowner needs, covering everything from no upfront costs and maintenance-free solutions to greater control and ultimate ownership at term’s end.

Solar Lease Agreements: The Path to Free Solar

A solar lease lets you put solar panels on your roof for no front cost. In a lease, a solar company installs panels for free, and you pay a set amount each month to use the solar system—usually less than your old electric bill. The company owns, maintains, and repairs the solution, so you focus on saving money.

Solar leases are attractive for those wanting immediate savings without large investment, and are often marketed as “free solar” because you pay nothing up front. However, you will have a lease term (usually 15–25 years), after which you may have the option to buy the panels or upgrade your system.

Solar Loan Options for Zero Upfront Cost Solar Panels

A solar loan works like any installment loan: you borrow the money to buy a solar system, and then repay over time with fixed monthly payments. The major benefit is ownership—you get the panels, benefit from federal tax credits and local incentives, and can increase your home’s value. With zero money down, solar loans enable homeowners to access renewable energy without draining savings.

With competitive interest rates and customizable terms, solar loans can be tailored to your budget. Look for loans with no prepayment penalties and terms that maximize tax credits or savings from your local utility company.

Power Purchase Agreements (PPAs) Explained

Under a power purchase agreement (PPA), a third party installs zero upfront cost solar panels on your home. You don’t own the panels; instead, you agree to buy the power they produce at a set rate, typically cheaper than standard utility pricing. This lets you lock in long-term energy savings while skipping ownership responsibilities and front costs.

PPAs are ideal for those seeking predictability—your rates are fixed or only rise slightly each year. The provider handles installation, maintenance, and repairs, making it simple and hassle-free for homeowners aiming to reduce their carbon footprint and utility bills without investing up front.

| Financing Option | Upfront Cost | Ownership | Maintenance Responsibility | Savings Potential |

|---|---|---|---|---|

| Solar Lease | $0 | Provider | Provider | Moderate–High |

| Solar Loan | $0 (with qualifying loans) | Homeowner | Homeowner | High (plus tax credits) |

| Power Purchase Agreement | $0 | Provider | Provider | Moderate |

How Zero Upfront Cost Solar Panels Work

Zero upfront cost solar panels make the process as simple and seamless as possible. The journey begins with evaluating your home and ends with your solar install, followed by immediate access to cheaper, cleaner energy. These solutions are designed to deliver maximum convenience, savings, and transparency.

The qualification process is typically straightforward, involving an assessment of your property’s solar potential, your energy usage, and a review of your credit (in certain financing options). With clear contract terms, defined monthly payments, and reliable maintenance, you gain peace of mind—and a future-proof energy solution.

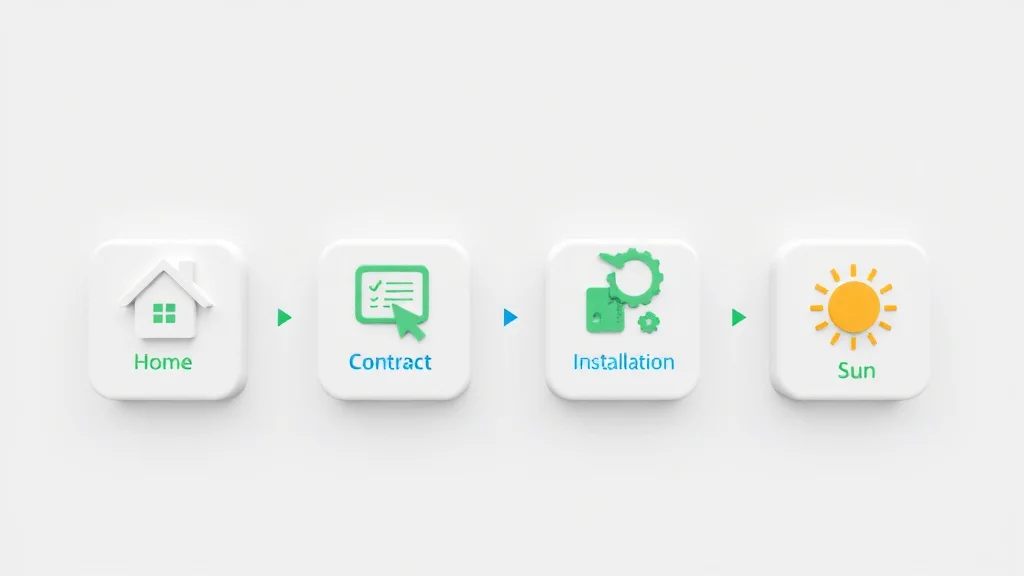

Step-by-Step Guide: Getting Started With Zero Upfront Cost Solar Panel Installation

- Evaluate home suitability for solar panels: Professional assessment determines if your location, roof angle, and sun exposure are ideal.

- Explore solar financing options and offers: Research solar leases, loans, and PPAs to match your budget and ownership preference.

- Compare quotes from providers specializing in zero upfront cost solar panels: Collect detailed offers outlining savings and responsibilities.

- Review and sign your selected agreement: Read contracts carefully, focusing on rates, terms, and end-of-term options.

- Schedule and complete your solar install: Set a date for installation—often completed within a day or two—followed by final inspections and activation.

Eligibility Criteria for Zero Upfront Cost Solar Panels

To qualify for zero upfront cost solar panels, providers generally consider your home’s sun exposure, roof condition, and your creditworthiness (for loans or leases). You’ll also need to live in a region where solar financing options—like solar leases, solar loans, or PPAs—are available. Some utility companies offer location-based incentives, potentially making your system even more cost-effective.

Every program has unique requirements. Working with a reputable solar company helps ensure you get matched with the right solution for your circumstances. As more states and utility companies promote renewable energy, the qualification process continues to become more inclusive.

The Pros and Cons of Zero Upfront Cost Solar Panels

Zero upfront cost solar panels dramatically expand access to clean energy but, like any financial commitment, require homeowners to weigh both benefits and trade-offs. Understanding these factors helps in making an informed decision for your household’s future.

Upfront cost savings, streamlined installation, and ongoing support contrast with the obligations and long-term contracts involved. By thoroughly reviewing your agreement, you can maximize your benefits while minimizing surprises.

Advantages: Financial Accessibility and Clean Energy

- No large front cost required

- Lower energy bills immediately

- Access to free solar installation for eligible homes

Homeowners experience real financial relief with zero upfront cost solar panels. You can start saving on your energy bills right away and participate in the clean energy movement. Maintenance and repairs are often included, and for those who qualify, going solar truly requires little to no out-of-pocket investment.

Potential Drawbacks and Considerations

- Possible long-term commitments

- Understanding your power purchase agreement

- Impact on home sale or refinancing

Though zero upfront cost arrangements ease entry, they usually involve contracts lasting 10 to 25 years. Make sure you understand how a solar lease or PPA might affect your ability to sell or refinance your home. Some buyers may see value in existing solar panels, while others may be wary of taking over a contract. Always scrutinize the fine print and work with experienced solar providers.

"Zero upfront cost solar panels can make solar accessible to more people, but it's vital to scrutinize contract details and future obligations."

People Also Ask About Zero Upfront Cost Solar Panels

Can I finance solar panels with no money down?

Answer: Yes, through various programs such as solar loans, solar leases, and power purchase agreements, it is possible to finance solar panels with no upfront cost. These financing options are structured to remove high initial payments and instead provide instant access to solar energy for homeowners.

What is the 33% rule in solar panels?

Answer: The 33% rule refers to the recommended ratio where your solar panels’ energy generation should cover about one-third of your total power needs, ensuring efficiency and cost-effectiveness — though specific coverage varies by household.

Is Trump getting rid of the 30% solar tax credit?

Answer: While political changes have influenced renewable energy incentives, as of 2024, the solar Investment Tax Credit remains, but homeowners should verify current policy details before making commitments to zero upfront cost solar panels.

Can you actually get solar for free?

Answer: 'Free solar' marketing typically refers to no upfront cost arrangements like leases and power purchase agreements. While you don’t pay upfront, you’ll make monthly payments or purchase the generated power at a set rate.

Analyzing the Cost Savings of Zero Upfront Cost Solar Panels

Choosing zero upfront cost solar panels not only eliminates large initial investments but begins delivering energy bill reductions right away. The key factor is replacing expensive utility rates with a lower-cost, predictable monthly payment for clean, home-generated power.

Savings accumulate quickly when a solar company’s fixed PPA or lease rates undercut traditional electric bills. In some regions, you can even sell excess power back to the grid, further boosting returns and shortening the payback period of your solar investment.

How Zero Upfront Cost Solar Panels Reduce Energy Bills

Systems sized according to your energy consumption allow you to generate a significant percentage of your own electricity. As a result, most homeowners see a drop in their monthly utility costs from day one. This effect grows over time as energy prices rise, while your solar lease, loan, or PPA payments often stay stable. Plus, with state and federal solar incentives, the savings can be even more dramatic, maximizing your return on investment.

Solar companies often offer energy monitoring tools so you can track your system’s performance and realize firsthand the difference solar power makes to your bottom line.

Estimating Monthly and Long-Term Returns

Calculating your solar returns involves understanding both immediate savings and the longer-term financial picture. Monthly, your new payment might replace the bulk of your standard utility bill. Over the contract, savings can total thousands—even tens of thousands—of dollars. And with solar loans, you can eventually own the system outright, enjoying free solar electricity after repayment.

Be sure to use an online solar calculator or provider estimates to model different solar financing options, including maintenance, insurance, and any future rate escalations, to see the clearest picture of your long-term value.

Video Explainer:Zero Upfront Cost Solar Panels vs. Traditional Solar Panel Purchases

It’s important to weigh the pros and cons of zero upfront cost solar panels against purchasing panels outright. While a traditional purchase gives immediate ownership, access to all solar tax benefits, and the greatest lifetime savings, the upfront cost can be prohibitive. Zero upfront cost solutions offer immediate access to clean energy and savings, but with contractual obligations and potentially less long-term flexibility.

If high up-front costs have been holding you back from installing solar power, zero upfront cost financing options can make solar a reality—giving you the chance to begin saving immediately and updating your home for a sustainable future.

| Feature | Traditional Purchase | Zero Upfront Cost |

|---|---|---|

| Upfront Cost | High (can be $10,000+) | $0 |

| Ownership | Homeowner | Provider / Homeowner (with solar loan) |

| Tax Credits | Yes, direct access | Only with solar loan (not lease or PPA) |

| Maintenance | Homeowner | Provider (lease/PPA) |

| Savings Potential | Highest (after payback) | Moderate–High (immediate, lower overall) |

Choosing the Best Zero Upfront Cost Solar Panels Provider

Finding the right provider is crucial to a successful solar experience. The best solar company will explain all solar financing options, clarify contract terms, and support your installation from start to finish. Look for responsive customer service, robust maintenance programs, and transparent agreements outlining monthly payments, warranty, and end-of-term choices.

Read reviews, ask for references, and ensure your provider offers solutions tailored specifically for zero upfront cost solar panels. Working with a reputable installer guarantees that you maximize benefits while avoiding hidden fees or unwelcome surprises down the road.

What to Look For in a Free Solar Provider

Consider companies with strong track records, industry certifications, and high customer satisfaction ratings. Assess their responsiveness to warranty claims, clarity in communication, and range of financing options—especially those that fit your long-term energy goals and budget. Confirm their experience with zero upfront cost solar panels, as these arrangements involve specialized contracts and installation expertise.

Be proactive: compare multiple offers, examine terms in detail, and check if your prospective provider will help you leverage local or federal tax credits for additional savings.

Questions to Ask Before Signing Any Zero Upfront Cost Agreement

- What happens at the end of the lease or agreement period?

- Are solar panels and installation truly free of front cost?

- What maintenance and warranty support is offered?

- How will the financing option affect your utility savings?

Request written answers to these questions before committing. Transparency now means fewer headaches later—ensuring your zero upfront cost solar panel investment delivers all promised benefits.

Common Myths About Zero Upfront Cost Solar Panels

Despite their growing popularity, some misconceptions persist about free solar and zero upfront cost solar panels, which can confuse or discourage homeowners. Clearing up these myths is essential to making empowered decisions.

From contract length to the notion of “free solar” and the impact on homeownership, let’s break down the truth behind the marketing.

Dispelling 'Free Solar' Misconceptions

The term “free solar” often appears in advertisements, but it’s vital to recognize that it refers to no upfront cost rather than completely cost-free energy. You won’t pay for the panels or installation at the beginning, but you will pay either a set monthly fee (lease) or a discounted price for the electricity produced (PPA). Carefully review your contract to understand your monthly payments and service responsibilities.

Trust reputable solar installers who fully explain terms and set realistic expectations around utility bill savings, contract lengths, and any end-of-term decisions related to your solar system.

Clarifying What 'Zero Upfront Cost' Really Means

“Zero upfront cost” means that installation and equipment fees are deferred or covered by your chosen financing option. While this lowers barriers to entry, you remain responsible for agreed payments over the contract period. Think of it as a subscription to solar power, not an outright gift.

Read the fine print, and ask how upgrades, home sales, or refinancing could affect your solar arrangement. Proper understanding ensures you access all the benefits promised by zero upfront cost solar panels—without unwelcome surprises.

Frequently Asked Questions (FAQ) on Zero Upfront Cost Solar Panels

Are zero upfront cost solar panels available nationwide?

Availability varies by state, local incentives, and the presence of qualified providers. While most areas have at least one provider offering zero upfront cost programs, always check for eligibility and competitive offers near you.

Do zero upfront cost solar panels affect home value?

Installing solar panels often raises a home’s value, but the effect depends on ownership structure. Panels owned through a solar loan can increase resale price significantly, while leases and PPAs may require extra coordination during the sale process. Make sure buyers understand and are willing to take over the contract when selling a solar-equipped house.

Can I still use utility grid power with zero upfront cost solar panels?

Yes. Your home remains connected to the grid for consistent power, ensuring you can access electricity any time your solar system isn't generating enough, such as at night or during cloudy periods.

What happens to my solar panels if I move?

If you move, your options will depend on your contract type. With a loan or purchase, you can sell the system with your home. With leases or PPAs, buyers may need to assume the agreement, or you may pay a transfer fee. Ask your provider for details before signing.

Key Takeaways for Homeowners Considering Zero Upfront Cost Solar Panels

- Zero upfront cost solar panels lower the barrier to clean energy

- Financing options include leasing, loans, and purchase agreements

- Always review provider credentials and contract terms thoroughly

Next Steps: Power Your Home With Zero Upfront Cost Solar Panels

Ready to experience energy savings and environmental benefits from zero upfront cost solar panels? Buy Your New Home With Zero Down Reach Solar Solution

Conclusion: Zero upfront cost solar panels make it easier than ever to switch to clean energy and start saving. By understanding your options and carefully reviewing providers, you can enjoy a brighter, more sustainable future without the burden of high initial costs.

As you consider your next steps toward a solar-powered home, remember that the renewable energy landscape is shaped by more than just technology and financing—it’s also influenced by policy and market trends. Staying informed about the broader forces at play can help you make smarter, future-proof decisions for your household. For a deeper dive into how political actions and government decisions are impacting clean energy jobs and the future of renewables, explore the comprehensive overview on the impacts of political actions on offshore wind jobs in America. Gaining this perspective can empower you to advocate for sustainable energy solutions and maximize the long-term benefits of your solar investment.

Add Row

Add Row  Add

Add

Write A Comment